defer capital gains tax stocks

1 week ago Nov 05 2019 capital gains sale proceeds cost basis purchase price of stock Should you sell the stock during your. Luckily the tax laws provide for several ways to defer or even completely avoid paying taxes on your securities sales.

Tax Deferral How Do Tax Deferred Products Work

10 Ways To Avoid Capital Gains Tax on Stocks That Pay Dividends.

. Whether you invest in dividend-paying stocks or growth stocks that do not. Beware however as trying to do this with your kids can disqualify the 0 percent treatment because the kiddie tax is triggered on gifted stock sold to children younger than 19. Learn about long- and short-term capital gains tax on stocks.

How can I defer my capital gains tax. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain. Wait at least one year before selling a property.

The gain is deferred until December 31 2026or to the year when the. However the Tax Cut and Jobs Act TCJA which took effect on Jan. Utilizing losses is the least attractive of all the.

PO Box 30080-00100Nairobi Kenya. Sell the Property After 1 Year. How to Defer Avoid Paying Capital Gains Tax on Stock Sales 3 days ago Dec 01 2019 That avoids the capital gains tax completely.

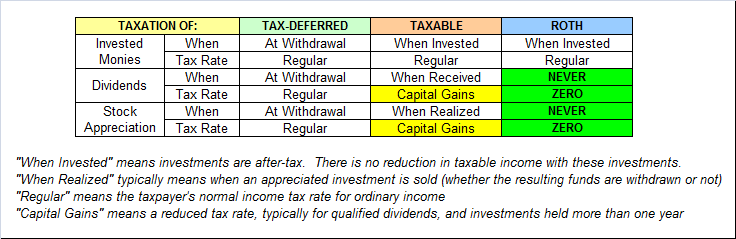

7 Methods for Investors 4 days ago Strategy 1. Either way you can eliminate minimize. Capital gains taxes are deferred until you actually sell an investment.

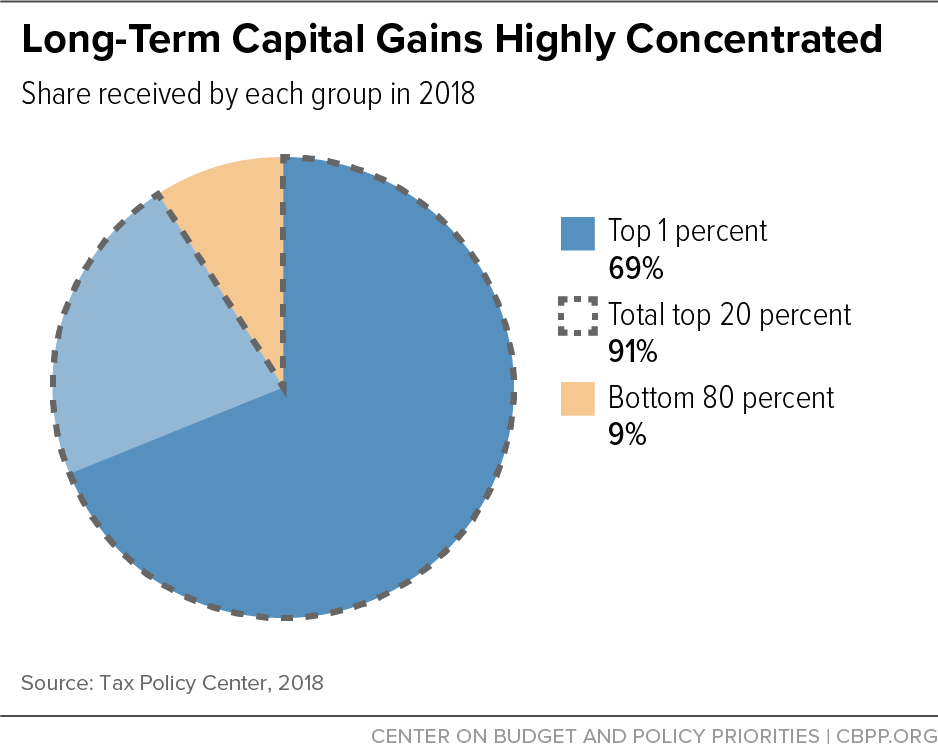

6 Ways To Defer Or Pay No Capital Gains Tax On Your. The most well known strategy for reducing capital gains taxes on stocks is to sell other stocks at a loss and use those losses to offset the gains for tax purposes. The markets are hitting all-time highs so if you are thinking of selling stocks now or in the near future there is a good chance that you will have capital gains on the sale.

Plus it generates for you a bigger tax deduction for the. Here are 14 of the loopholes the governments gain tax unintentionally incentivizes. So if you have a 50000 gain on paper you.

Standard Group Plc HQ Office The Standard Group CenterMombasa Road. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange. May help reduce potential estate.

6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate. Investors can realize losses to offset and cancel their gains for a particular year. Long-term capital gains are generally taxed at special capital gains tax rates of 0 percent 15 percent and 20 percent depending on your taxable income.

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

Capital Gains Tax In The United States Wikipedia

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

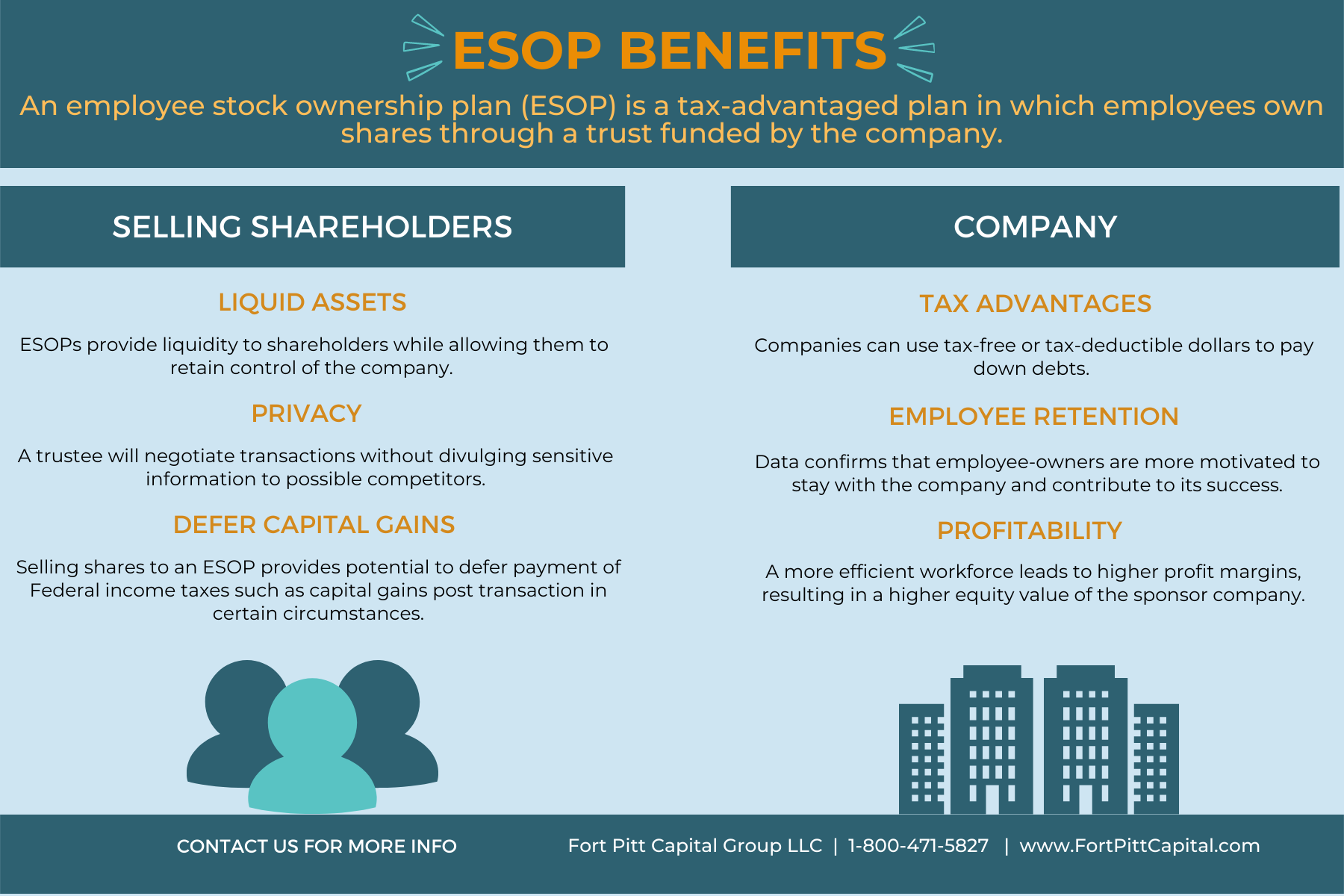

Is An Esop Right For Your Business Fort Pitt Capital Group

Rsu Taxes Explained 4 Tax Strategies For 2022

Minimize Defer Capital Gains Taxes Toplitzky Co

Capital Gains Tax In The United States Wikipedia

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

How To Give To Charity In The Most Tax Effective Way

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

The Capital Gains Tax And Inflation Econofact

Taxes Pay 15 Now Or 25 Later Seeking Alpha

Lifeafar Capital How To Avoid Paying Capital Gains Tax When You Sell Your Stock

How To Defer Capital Gains Through A 1031 Tax Exchange Elika

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Irs Extends The Opportunity To Defer Capital Gains

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)