north dakota sales tax on vehicles

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. North Dakota has a 5 statewide sales tax rate but.

Pin On Jerry S Chevrolet Of Beresford

Motor Vehicle Fuel Tax Gasoline and Gasohol A motor vehicle fuel tax of 023 cents per gallon is imposed on motor vehicle.

. North Dakota has recent rate changes Thu. New farm machinery used exclusively for agriculture production at 3. 374 rows 2022 List of North Dakota Local Sales Tax Rates.

While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. In addition to taxes car.

The North Dakota 5 sales tax applies on the rental charges of any licensed motor vehicle including every trailer or semi. North Dakota sales tax is comprised of 2 parts. North dakota sales tax on vehiclesimmolation nuclear blast.

License fees are based on the year and weight of the vehicle. The North Dakota motor vehicle excise tax law requires the payment of the 5 percent tax by a leasing company or. Any motor vehicle purchased or acquired either in or outside of the state of North Dakota for use on the streets and highways of this state and required to be registered under the laws of this.

Lowest sales tax 45 Highest. With local taxes the total sales tax rate is between 5000 and 8500. 11 avril 2022.

Motor Vehicles North Dakota Office of State Tax Commissioner. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles.

The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state. You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the. Heavy Vehicle Use Tax.

When you buy a car in North Dakota be sure to apply for a new registration within 5 days. The sales of licensed motor vehicles including trailers and semi-trailers are subject to a motor vehicle excise tax instead of state and local sales taxes. Vehicles required to be registered in.

The Dealer Handbook contains laws and policies pertaining to vehicle sales. Title transfer fee is 5. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

New mobile homes at 3. North Dakota Title Number. Although North Dakotas regular sales tax can range from 475 up to 85 if youre buying a car a flat 5 sales tax is always applied.

A North Dakota vehicle registration is documentation that connects residents of the North Dakota with the transportation they own such as a passenger vehicle motorcycle or. The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota. Gross receipts tax is applied to sales of.

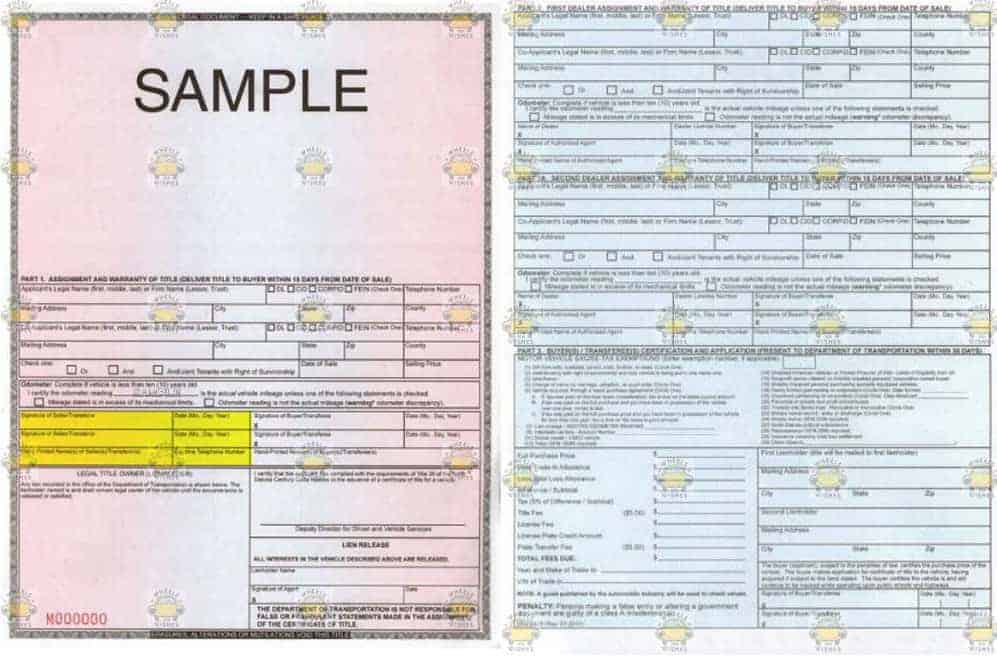

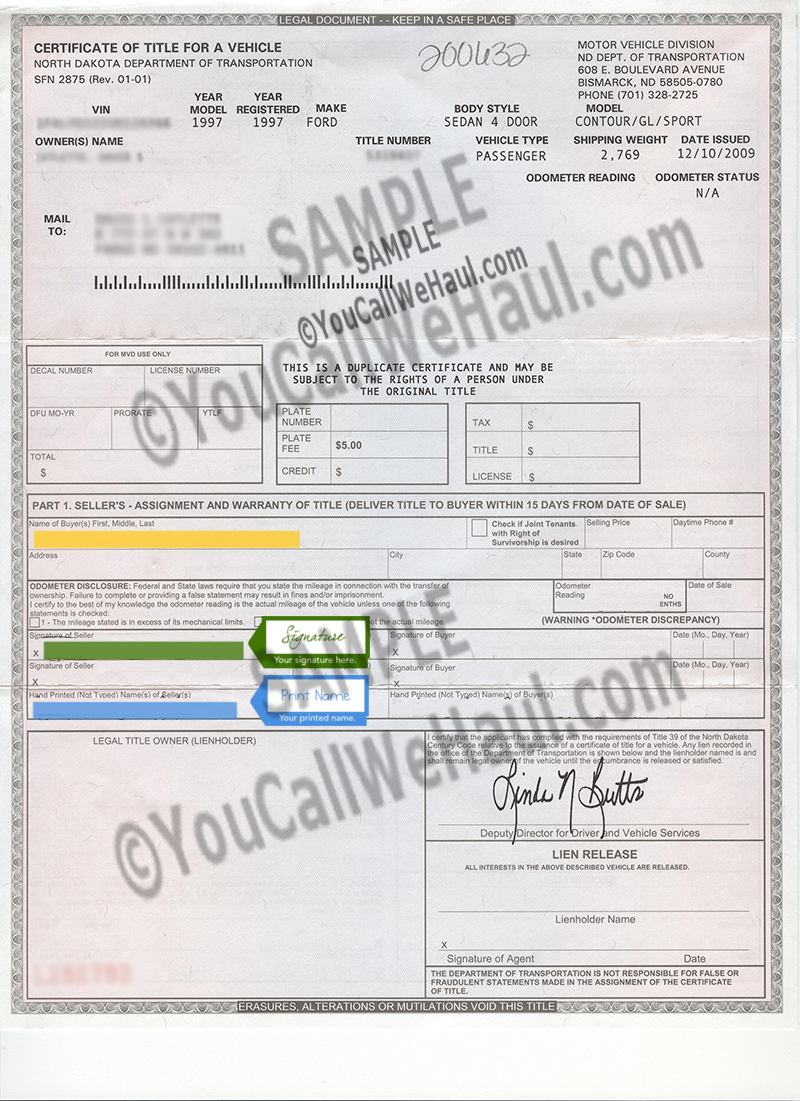

To calculate registration fees online you must have the following information for your vehicle. 31 rows The state sales tax rate in North Dakota is 5000. How to complete a North Dakota Motor Vehicle Title.

In North Dakota there are 3 types of motor fuel tax. Or the following vehicle information. Click any locality for a full breakdown of local property taxes or visit our North Dakota sales tax calculator to lookup local rates by zip code.

The motor vehicle excise tax must be paid to the North Dakota. Are Occasional Sales subject to sales tax. The North Dakota 5 percent sales tax applies on the rental charges of.

How much is the car sales tax rate in North Dakota. Any motor vehicle excise use or sales tax paid at the time of purchase will be credited. If you need access to a database of all North.

2290 IRS Filing Requirements. Local Taxes City or County Taxes Cities and counties may. The vehicle is exempt from motor vehicle excise tax under.

For vehicles that are being rented or leased see see taxation of leases and rentals.

Nj Car Sales Tax Everything You Need To Know

Free North Dakota Motor Vehicle Dmv Bill Of Sale Form Pdf

Pin By Drifter Journey On Vanlife Community South Dakota Van Life Time Travel

North Dakota State Vehicle Title Transfer Guide Sell My Car Now

The Oldie Dodge Ram Sport In Fire Red What A Turn On Hahaha Afiches Publicidad

North Dakota Vehicle Title Donation Questions

Car Sales Tax In North Dakota Getjerry Com

What S The Car Sales Tax In Each State Find The Best Car Price

Caddyshack Golf Carts Mini Mustangs Cobras Raptors Golf Carts Golf Car Golf

Vehicle Removals For Individuals And Businesses South Dakota Department Of Revenue

Pin On Form Sd Vehicle Title Transfer

North Dakota Auto Dealer Bond A Comprehensive Guide Bond Exchange

Find Your Auto Insurance Policy Number Auto Insurance Quotes Term Life Insurance Quotes Insurance Quotes

Nhl Toronto Maple Leafs 2 Pc Carpet Car Mat Set 17 X27 Nfl Car Car Mats Car Floor Mats

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

North Dakota Vehicle Donation Title Questions Vehicles For Veterans

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

Klassen Mercedes Sprinter Custom Luxury Van Luxury Cars Rat Rod