capital gains tax proposal canada

In our example you would have to include 1325 2650 x 50 in your income. The amount of tax youll pay depends on how much youre earning from other sources.

Your Cryptocurrency Tax Guide Turbotax Tax Tips Videos

Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada.

. It then rose to 50 until 1990 when it rose again to 75. In the same way that you only pay tax on half your capital gain in Canada you can only offset half your loss. Canada imposes very low corporate tax rates on small businesses.

The first proposed constraint is to impose an age limit on access to the lifetime capital gains exemption. As having the highest rate putting the US. The proposal is so unpopular with voters that when a senior bank economist suggested in a research paper earlier this year that the principal residence exemption from capital gains tax be reviewed.

Thats because their top. Capital gains and surplus stripping. In the case of a true sale of an investment property capital gains tax must be paid when you file your tax return for the year the sale occurred.

In Canada 50 of the value of any capital gains is taxable. Election platform the NDP proposed to increase the capital gains inclusion rate. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

Feb 7 2022. On average across the provinces the combined corporate tax rate for small Canadian-controlled private corporations CCPCs is now 12 per cent compared to an average top personal tax rate of 52 per cent. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

More than 80 percent of gains were declared by the 95 percent of Canadian taxfilers with total incomes over 100000. Its only in the last 20 years since 2000 that the inclusion rate dropped again to 50. In other words if you sell an investment at a higher price than you paid realized capital gains youll have to add 50 of the capital gains to your income.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Under this new policy there would be a new sliding scale tax rate applied to capital gains on home sales. The capital gains tax rate in Ontario for the highest income bracket is 2676.

In the last election the Conservative Party warned that a Liberal government would look to cash in on rising home values by levying a capital gains. For the majority of assets held for longer than one year capital gains tax rates in 2021 will range from 0 to 15 respectively. Theres little stopping the capital gains tax from rising again especially if the government needs increased.

A typical years capital gains tax rate is 10 to 12 22 to 24 32 to 35 or 37 on most assets. The sale price minus your ACB is the capital gain that youll need to pay tax on. The news release that accompanied the Proposals.

If youve got more losses than gains you can carry losses forward to future tax years - these can be carried forward indefinitely until the losses are fully. Homeowners would be far more reluctant to sell their homes given that they would have to pay a considerable amount of money in capital gains tax. When the tax was first.

The federal budget date has not yet been announced but if a change is. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province. Of the total 546 percent was declared by taxpayers with incomes over 250000.

The Department of Finance has proposed three new constraints on eligibility aimed at limiting the ability of Canadian taxpayers to multiply access to the lifetime capital gains exemption. However the CRA recognizes that property owners may face difficulty paying capital gains tax when a sale has not occurred. You wont gain any gains that you incur starting on January 1 2022 but rather any gains that you may incur in that period from December 31 2022 the taxable year.

In Canada 50 of the value of any capital gains is taxable. The Proposals include amendments to both the Income Tax Act ITA and the Excise Tax Act ETA. And American business at a competitive disadvantage.

To 75 from 50. So in the example above youd only be paying tax on a capital gain of 250 but you could offset it with a loss of 250. Has one of the highest capital gains tax rates in the world and new research conducted by EY shows that the Biden Administrations proposal to raise the capital gains tax rate to 493 will clearly establish the US.

Capital gains tax in Canada. The same rules apply in the case of a change of use ie. This has Canada speculating again if a hike to the capital.

This proposal appears to be focused on instances where the property that may be eligible for the lifetime capital gains exemption is shares of a corporationThe proposed reasonableness test is the same as for the proposed changes to the tax on split income. Youre then taxed based on your particular provinces tax bracket. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

The long-term capital gains tax rate is 0 15 and 20. Is Capital Gains Tax 35. If the government were to introduce a home equity tax proposal in Canada whereby homeowners had to pay taxes on a home equity payout from their primary residence the fallout could be considerable.

The capital gains tax has always been fluid before 1972 it didnt exist. NDPs proto-platform calls for levying. The capital gains brackets for 2022 have short-term capital gains taxed at a particular ordinary income rate.

On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the 2021 Federal Budget. Person clients living in Canada who sell assets Mr. In all Canadians realized 729 billion in taxable capital gains.

While alive the proposed increase to the capital gains tax could dramatically impact high-net-worth US. This is extraordinarily bad policy that will hurt Canadian families. A 50 tax after one year of ownership 25 after two years 15 after three years 10 after four years and 5 after five years Scheer said.

Gains inclusion rate may occur in the upcoming federal budget.

Your Cryptocurrency Tax Guide Turbotax Tax Tips Videos

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Is A Capital Gains Tax Right For New Zealand

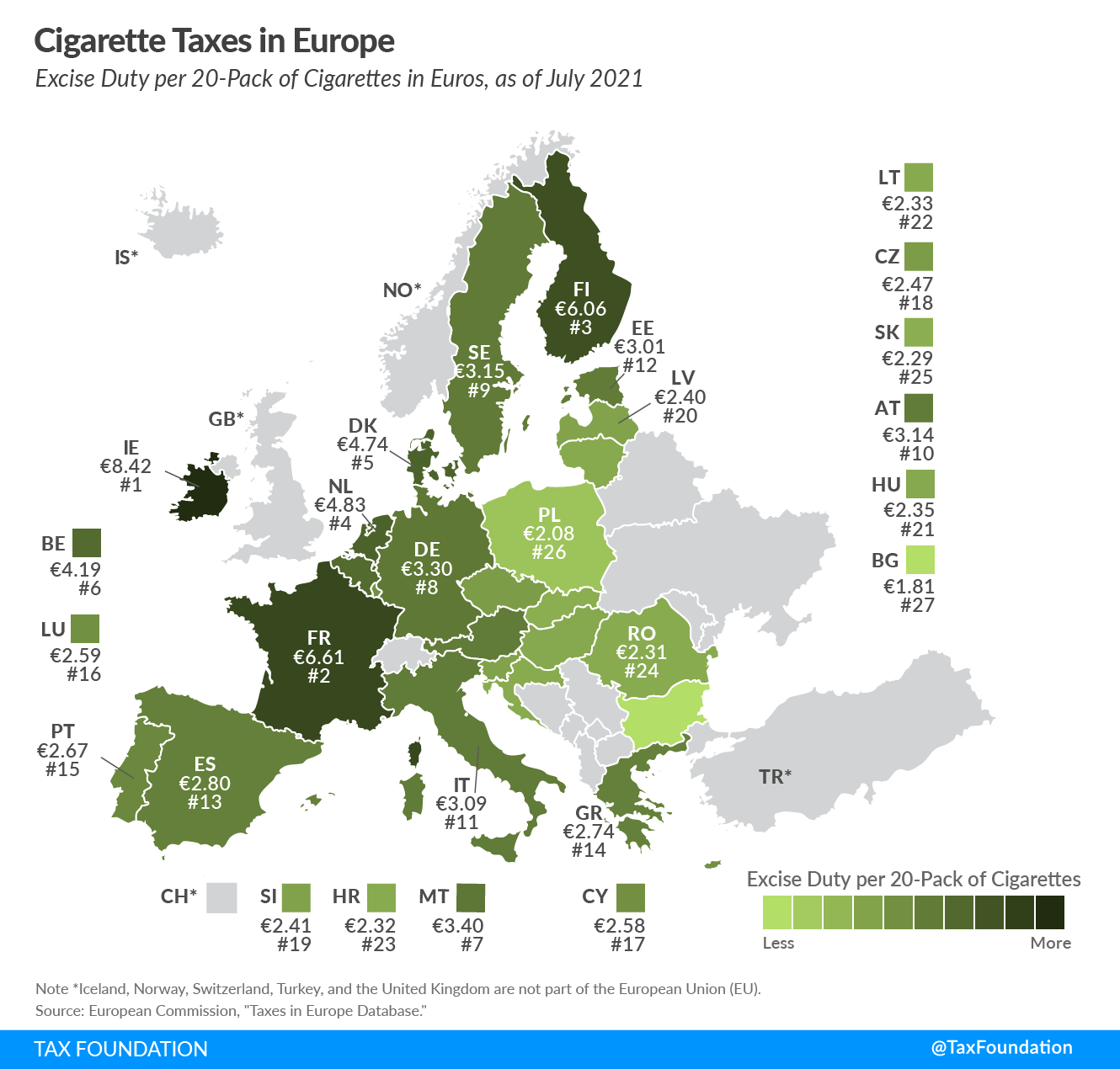

Cigarette Taxes In The Eu European Cigarette And Tobacco Tax Map

The States With The Highest Capital Gains Tax Rates The Motley Fool

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

The Truth About Capital Gains Tax In Belgium Tax Belgium

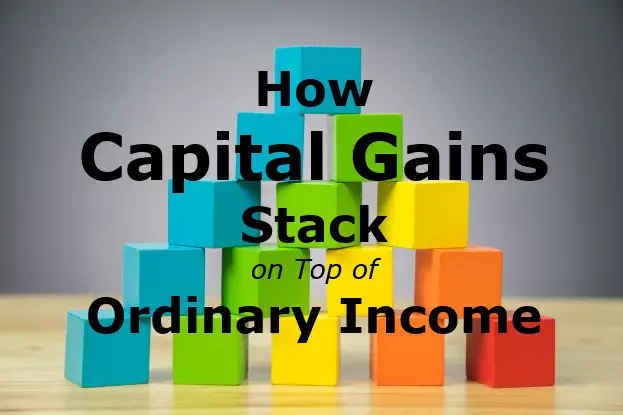

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

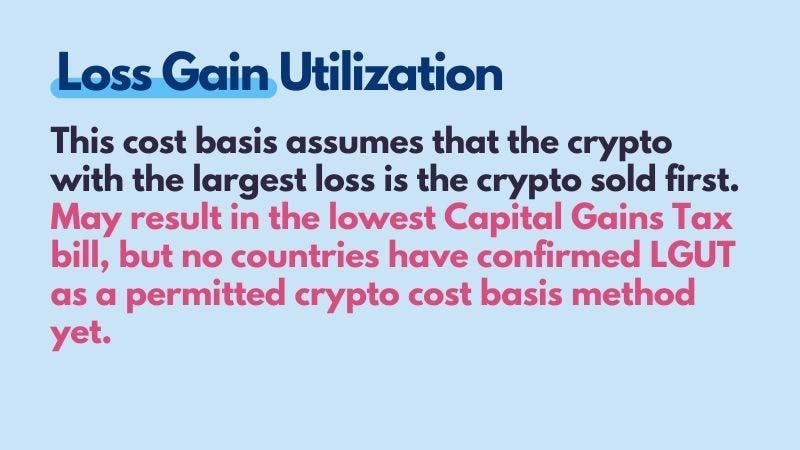

How To Calculate Cost Basis In Crypto Bitcoin Koinly

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How To Calculate Cost Basis In Crypto Bitcoin Koinly

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Income Tax Return E Filing E Filing Income Tax Returns Trutax Income Tax Return Tax Return Income Tax