who pays sales tax when selling a car privately in illinois

As the owner of the vehicle the lessor generally is liable for Illinois Use Tax and responsible for filing and paying this tax using Form RUT-25-LSE when the vehicle is brought into Illinois. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

How To Buy A Car From A Private Seller Carfax

Who pays sales tax when selling a car privately in Illinois.

. Sales taxes in Illinois are. This is the total of state and county sales tax rates. This tax is paid directly to the Illinois Department.

It ends with 25 for vehicles at least 11 years old. There is also between a 025 and 075 when it comes to. WHEN SELLING YOUR CAR Reporting a wrong purchase price is FRAUD.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. The buyer will have to pay. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle.

The Illinois state sales tax rate is currently 625. This tax is paid directly to illinois department of revenue. The Cook County sales tax rate is 175.

In addition to state and county tax the City of. If you are selling a car in illinois you must follow the following steps. Illinois Sales Tax on Car Purchases.

For vehicles worth less than 15000 the tax is based on the age of the vehicle. Who pays sales tax when selling a car privately in illinois. When you sell your car you must declare the actual selling purchase price.

The buyer will have to pay the sales tax when they. However you do not pay that tax to the car dealer or individual selling the car. Who pays sales tax when selling a car.

There is also between a 025 and 075 when it comes to county tax. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Use the illinois tax rate finder to find your tax.

Illinois Sales Tax on Car Purchases. To calculate how much sales tax youll owe simply. Arkansas House Bill would decrease car sales tax on.

Saying a SALE is a GIFT is FRAUD. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. The state sales tax on a car purchase in Illinois is 625.

Therefore you will be required to pay an additional 625 on top of the purchase price of the vehicle. It starts at 390 for. Steps To Take When Selling A Car In Illinois - Cash Cars Buyer.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. While a dealership selling a vehicle is responsible for sending the vehicles title transfer and sales tax to the Secretary of States office in a vehicle sales transaction between two private. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

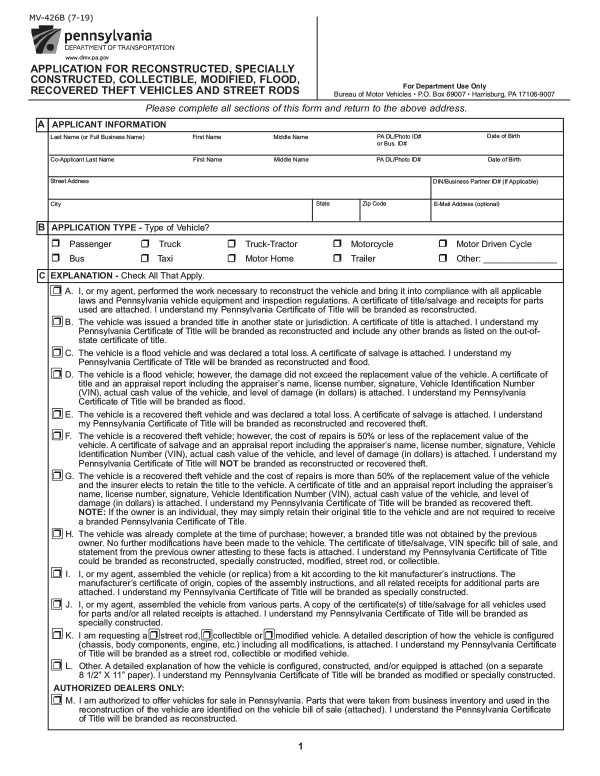

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Free Bill Of Sale Forms 24 Word Pdf Eforms

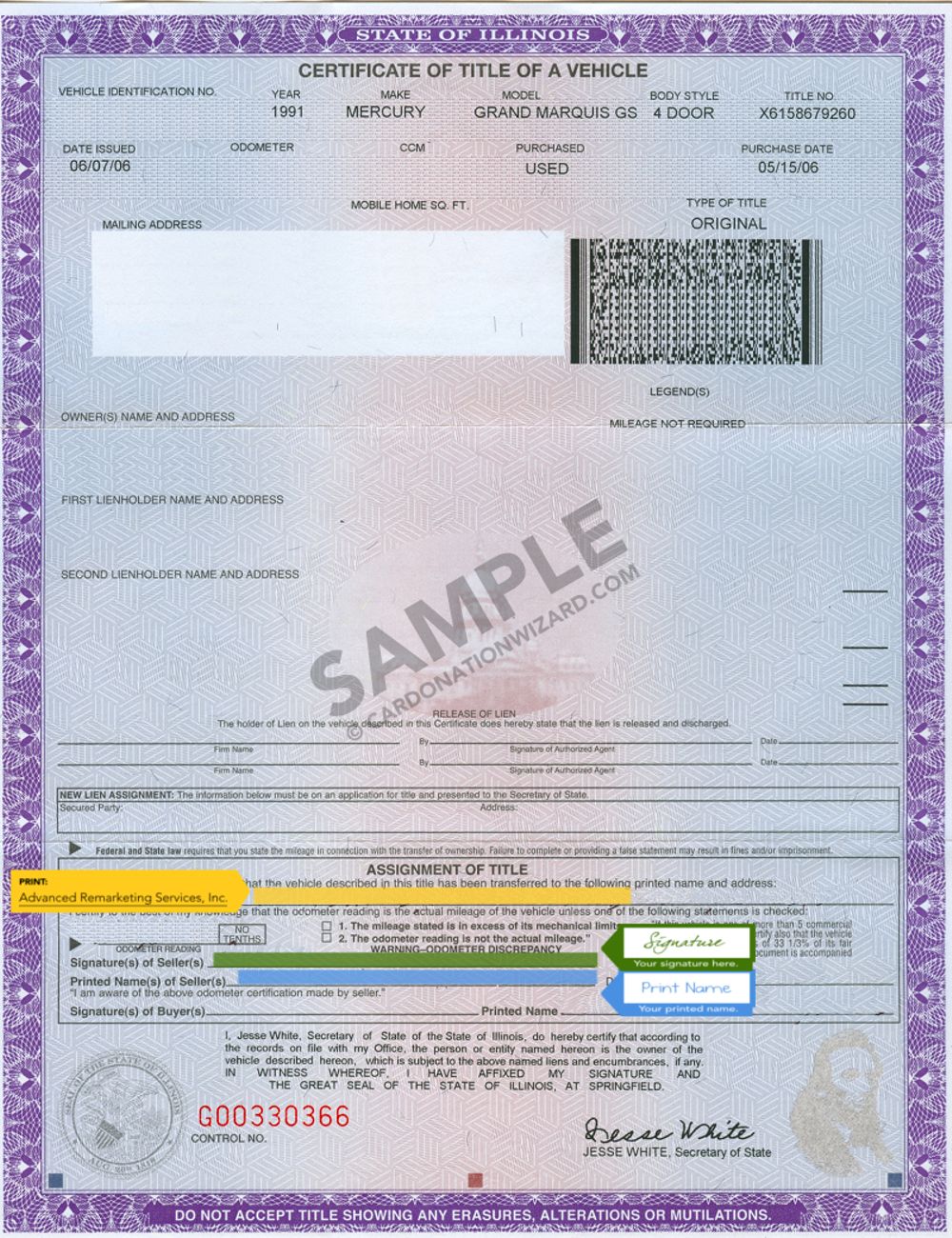

How Much Does It Cost To Transfer A Car Title In Illinois

Illinois Sales Tax Irv2 Forums

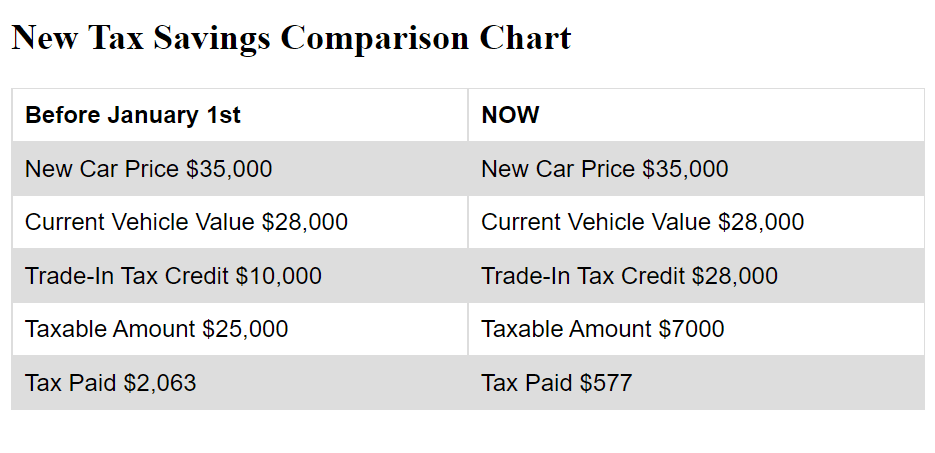

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet

Free Bill Of Sale Forms 24 Word Pdf Eforms

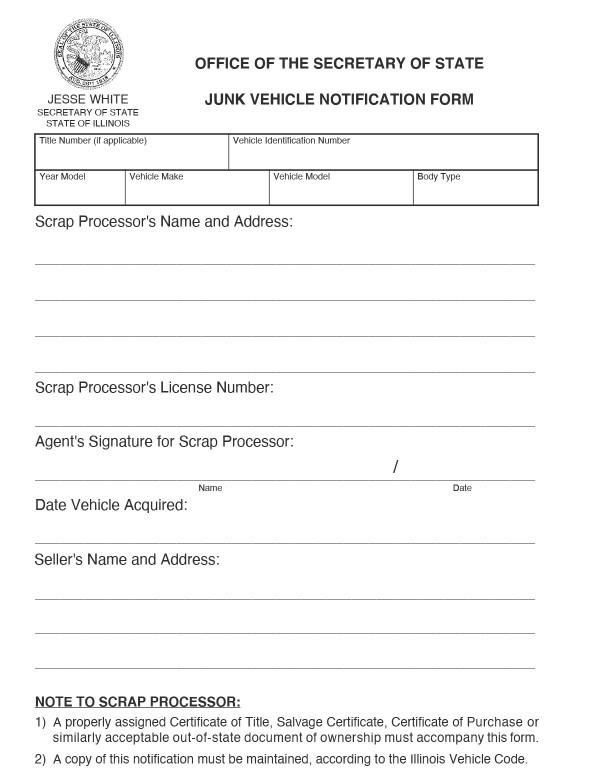

Illinois Bill Of Sale Forms And Registration Requirements

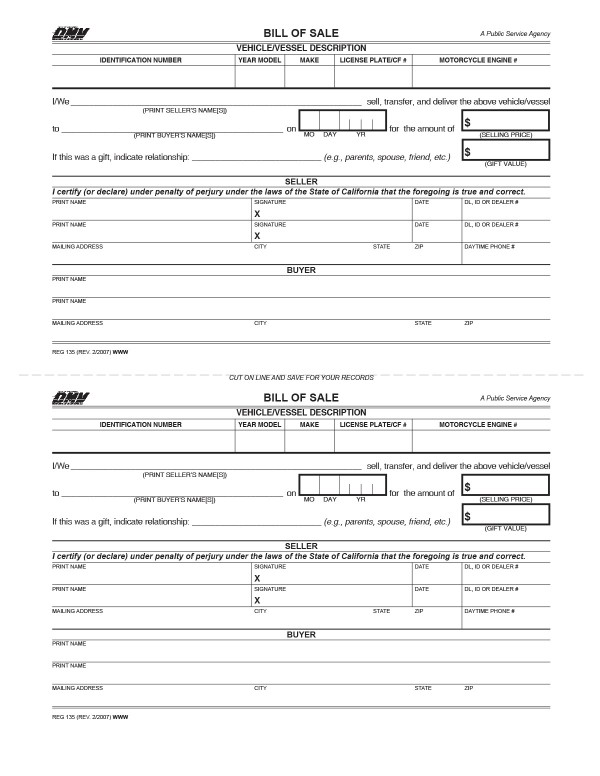

All About Bills Of Sale In California The Facts And Forms You Need

Free Tennessee Bill Of Sale Form Pdf Word Legaltemplates

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

What S The Car Sales Tax In Each State Find The Best Car Price

All About Bills Of Sale In New Jersey The Forms Facts You Need

What To Know About Taxes When You Sell A Vehicle Carvana Blog

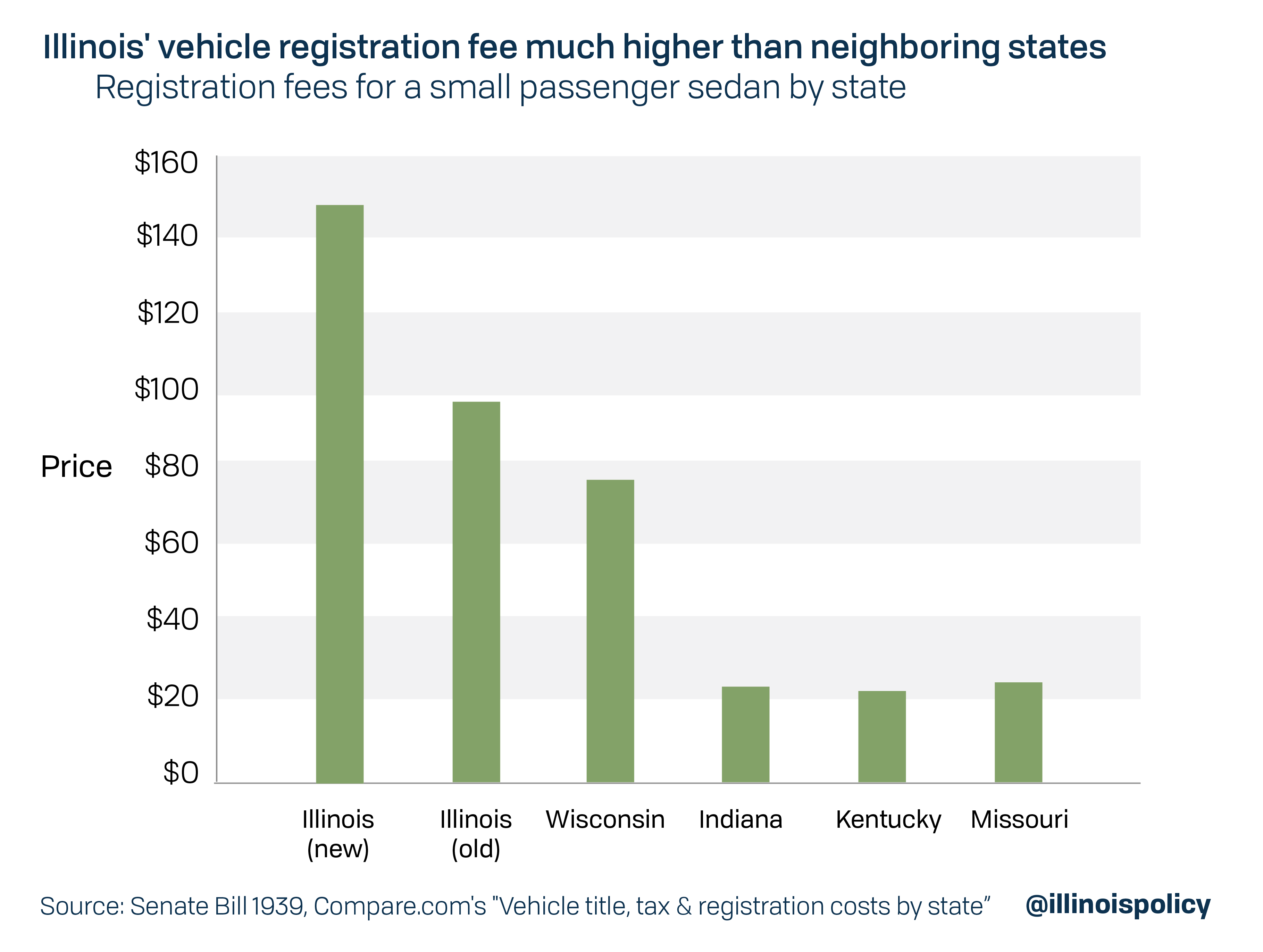

Illinois License Plate Sticker Among Most Expensive In The Nation

How To Transfer Car Title In Illinois Metromile

Can Buy A Car Below Market Value And Resell It For A Profit Without Registering And Paying Taxes On It In California Quora

Free Illinois Motor Vehicle Bill Of Sale

Buying From A Private Seller Vehicle Registration Titling And Fees Explained